This put up is offered by our associate, Opolis. Get employment instruments usually reserved for conventional “staff” like legitimately premium well being protection, high-quality retirement plans, semi-monthly paystubs, annual W2s, tax compliance, and extra with Opolis: https://opolis.co/freelancers-union/

What would you do with an additional $5000 or extra? Be part of the earnings and payroll tax-saving journey, entrepreneurs and unbiased contractors! At this time, we’re exploring small enterprise tax optimization methods in america that will help you shield your earnings.

The important thing to your financial savings begins with the authorized construction you select on your small enterprise. Due to a 2018 tax legislation change, many homeowners can now elect S-corporation standing to save lots of a ton of cash on their taxes.

S-corps provide enterprise homeowners wonderful tax breaks and monetary perks and are comparatively straightforward to arrange. But when you do not have one but, do not panic! Opolis makes that half straightforward.

Earlier than you dismiss this as one other mundane tax subject, let’s discover how one can preserve extra of what you earn–that’s enjoyable, proper? First issues first…

What’s an S-corporation?

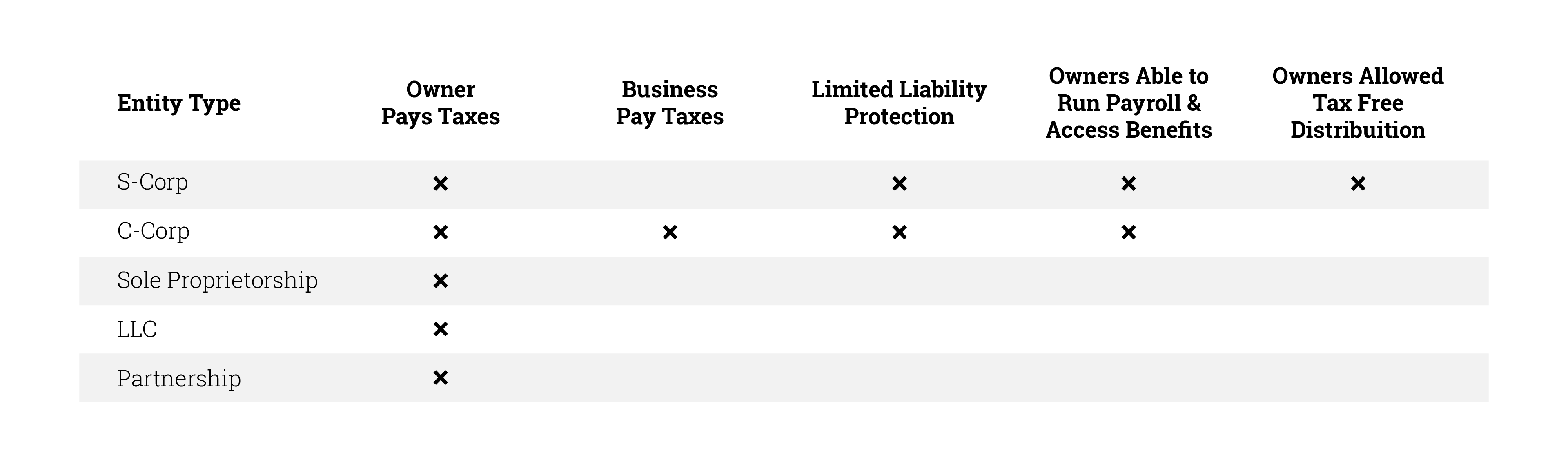

Merely put, an S-corporation (S-corp) is a novel tax election acknowledged by the IRS. It gives sure tax advantages and authorized protections for its homeowners:

- As a proud proprietor of an S-corp, you wield a nifty perk referred to as restricted legal responsibility safety. Translation? Your S-corp shields your private belongings in case somebody sues your organization.

- S-corps are companies that do not pay taxes on their earnings. As a substitute, the homeowners are accountable for paying taxes on the cash they make.” In contrast to C-corporations (C-Corps) the place each the corporate and its homeowners foot the tax invoice, S-corps dodge the double-taxation entice. And for you because the proprietor, that is the place among the tax financial savings are available.

- As an S-corp proprietor, it’s essential to pay your self a “affordable wage” as an worker. Opolis suggests allocating 50-70% of your online business revenue to your wage.

Chat with a CPA to find out the suitable proportion for you. This ensures that your wage is truthful and aligns together with your work. This does imply you’re now coping with worker payroll taxes, however extra on that later (i.e.: we received you!).

Many entrepreneurs shrink back from transitioning to an S-corp due to misconceptions about complexity and price. Many imagine that S-corps include lots of paperwork and costly administrative charges. Whereas they’ve extra formal necessities than sole proprietorships, the monetary advantages sometimes outweigh the additional duties.

So, how do S corps ship on their promise of tax effectivity? We hear you within the again:

“How will this truly save me money and time?” Let’s go.

Automate your Quarterly Tax Estimates by way of Payroll

First off, keep in mind that “affordable wage” you might be paying your self? You’re the worker of your personal gig, and when payday rolls round, Uncle Sam takes his lower immediately out of your paycheck. No extra ready till tax season to take care of that headache! Payroll deducts and remits these taxes semi-monthly.

Once you’re on the corporate payroll, your organization splits the FICA (self-employment) payroll taxes. The FICA tax fee (15.3%) contains Social Safety and Medicare as payroll taxes.

Your wage and the payroll taxes paid by your S-corp may be tax deductions for the corporate. This implies you could lower your expenses on taxes by deducting these bills. An effective way to scale back your tax legal responsibility and preserve extra of your hard-earned cash. Meaning much less stress come tax time and extra money in your pocket all year long.

You possibly can deduct certified enterprise earnings due to the Tax Cuts and Jobs Act. Make sure that to maintain correct data of those bills to reap the benefits of this tax profit. So when tax season hits, your general taxable earnings are decrease, and meaning you pay much less in taxes. Like magic, however with numbers.

Strategic Retirement Planning with an S-corp

For entrepreneurs eager on maximizing their retirement financial savings, electing S-corp standing presents a strategic benefit. S-corporations permit homeowners to take part in retirement plans that will not be accessible to sole proprietorships or partnerships. Which means that homeowners of S-corporations have extra choices for saving for retirement. This generally is a pivotal profit for these trying to safe their monetary future whereas decreasing present taxable earnings.

An S-corp can contribute to retirement plans, like a 401(okay) or SEP-IRA, for its proprietor. These contributions are tax-deductible, decreasing the general taxable earnings of the enterprise.

An S-corp proprietor can contribute $23,000 to a 401(okay). The S-corp can even add profit-sharing as much as the utmost restrict, decreasing the proprietor’s tax invoice considerably. This generally is a strategic method to serving to solopreneurs to attain their monetary objectives in the long term.

To sum it up:

- Your S-corp pays you immediately (just like the skilled you might be) by way of payroll every pay interval.

- Taxes are deducted out of your paycheck and despatched to the federal government every pay cycle. This implies you need not fear about a big tax invoice on the finish of the yr. You additionally do not need to make giant estimated quarterly tax funds.

- At tax time yearly, your online business claims your wage and profit insurance coverage premiums as deductible bills, which can decrease your taxable earnings.

Now let’s chat about how Uncle Sam taxes these candy, candy earnings out of your S-corp.

Escape the Self-Employment Tax Lure

The true magic of S-corps lies of their remedy of earnings.

S-corp homeowners can keep away from excessive self-employment taxes by solely paying taxes on their wage. They don’t have to pay taxes on any extra cash they take out of the enterprise. With an S-corp, you solely pay payroll taxes on the wage you earn, not on any additional earnings. Nevertheless, sole proprietors or single-member LLCs face excessive taxes on their whole earnings.

In case your S-corp makes $100,000 in earnings after bills, you’ll be able to pay your self a wage of $70,000. You possibly can then take the remaining $30,000 as dividends. This technique can prevent a ton in taxes in comparison with different entities.

S-corps are engaging to companies with completely different earnings ranges. Homeowners can change their draw primarily based on how the corporate is doing and their private monetary scenario.

So how does this shake out on your financial savings? Let us take a look at an instance.

Breaking Down the Math

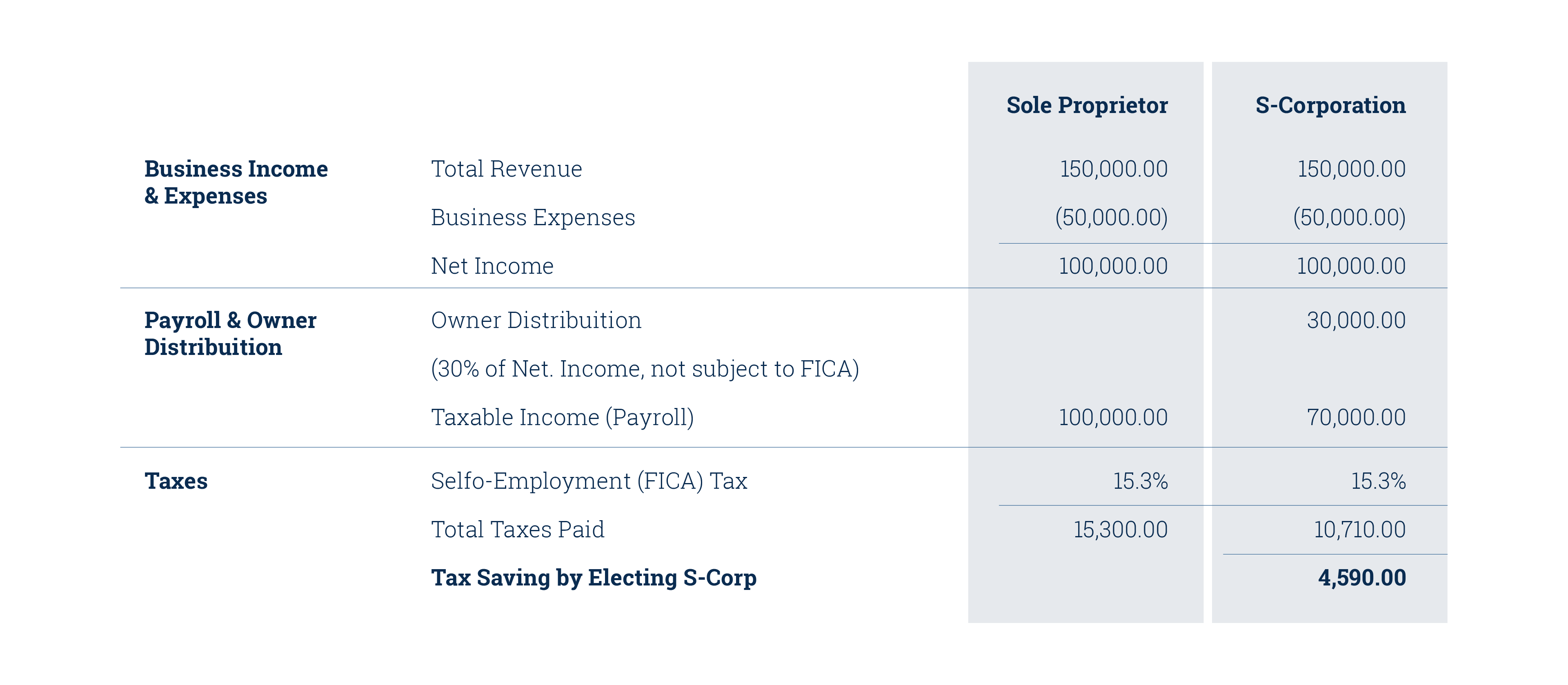

Meet Jane, a savvy guide pulling in $150,000 in income for her enterprise. She should select between working solo as a sole proprietor/LLC or becoming a member of the S-corp. Let’s break down her tax charges in each eventualities:

The Verdict

What are the tax financial savings between these two eventualities? $4,590 in extra cash in Jane’s pocket as a result of she elected S-corp!

The financial savings are staggering if Jane chooses to transform or arrange an S-corp and distribute 30-50% of earnings to herself as an alternative. Their construction provides wonderful tax financial savings for enterprise homeowners.

So, what would you do with an additional $5000 of after-tax earnings?

Is an S-corp Proper for Me?

For people trying to tweak their tax recreation and lock in some severe monetary stability, S-corps are an unimaginable alternative. Nevertheless, in case your annual S-corp web earnings falls in need of $80,000, diving into the S-corp realm may not be best for you, as 50-70% of $80k might not fulfill your State’s minimal wage necessities. To have your cake and eat it too, you want to have the ability to run an affordable wage and distribute sufficient tax-sheltered earnings to your self by way of proprietor distributions.

Optimize Your Tax Sport

Need assistance getting your S-corp began or transformed from one other enterprise construction? Turn out to be a Member of the Opolis Employment Commons!

Our seasoned stewards are able to information you thru setup and tax optimization. Opolis will help you maximize financial savings and decrease tax complications.

Safeguard your hard-earned money from the taxman’s clutches. Let’s flip your monetary desires into rock-solid actuality. Begin your financial savings now.

Satisfied by now? Go to https://opolis.co/freelancers-union/ to get began right this moment!