Let’s be actual: discovering medical insurance as a freelancer or Solopreneur could be a wrestle.

I’ve been self-employed for six years, and each single 12 months throughout open enrollment, I’m going via the identical exhausting course of. I spend hours on {the marketplace} evaluating plans I don’t perceive, calculating whether or not a Bronze plan with a $7,000 deductible or a Silver plan with a $5,000 deductible makes extra sense, and finally selecting the “least unhealthy” possibility that also prices manner an excessive amount of.

After which there’s the anxiousness. What if I get sick? What if I would like surgical procedure? Will my plan really cowl it, or will I uncover some obscure clause that leaves me with a $20,000 invoice?

If this sounds acquainted, you’re not alone. Medical health insurance is constantly ranked as one of many high challenges for self-employed people. The choices accessible—market plans, short-term protection, restricted plans—all include important drawbacks.

Cash Be aware: If an additional $1K–$5K/month would change your 2026 targets (debt, financial savings, journey, freedom), you’ll need to catch this: free dwell workshop from a freelancer who’s earned $4M+ on-line. No fluff. No gimmicks. An actual roadmap. 👉 Watch the coaching or save your seat right here »

That’s why I used to be genuinely intrigued after I heard about Solo Well being Collective.

Solo guarantees one thing completely different: a well being plan constructed particularly for Solopreneurs and freelancers, with clear pricing, nationwide protection, decrease prices than conventional insurance coverage, and no complicated coinsurance or hidden charges. It sounds virtually too good to be true.

So I hung out digging into Solo—speaking to their workforce, reviewing their plans, and evaluating prices to conventional insurance coverage. On this assessment, I’m sharing all the things I discovered about whether or not Solo is the well being plan breakthrough freelancers have been ready for.

Brief Reply: Ought to You Strive Solo Well being Collective?

Don’t have time for the total assessment? Right here’s my fast take:

YES: For those who’re a self-employed freelancer with an EIN, you’re typically wholesome, and also you’re annoyed with costly market plans. Solo typically prices considerably lower than conventional insurance coverage whereas offering substantial protection and wonderful help. Undoubtedly value getting a free quote.

PROBABLY NOT: In case you have important pre-existing situations, or should you’re employed part-time by an organization that gives advantages. Solo is particularly designed for really self-employed people.

What Is Solo Well being Collective?

Solo Well being Collective

Solo Well being Collective is a well being plan answer designed solely for self-employed people working as a “enterprise of 1.” Not like conventional insurance coverage or market plans, Solo makes use of a captive insurance coverage mannequin that creates a group of Solopreneurs who collectively share healthcare prices. It presents complete protection via a nationwide PPO community with over 1.4 million suppliers, clear pricing, tax-deductible premiums, and concierge help—all with out the complexity and excessive prices typical of conventional medical insurance.

Why we like Solo Well being Collective ‣

Solo Well being Collective stands out as a result of it’s constructed particularly for freelancers and solopreneurs who’re fed up with overpriced, complicated market insurance coverage. As an alternative of opaque premiums and limitless advantageous print, SOLO presents clear pricing, easy plan buildings the place the deductible equals the out-of-pocket most, and nationwide PPO entry with over 1.4 million suppliers. We particularly like that preventive care is roofed 100%, premiums are tax-deductible as a enterprise expense, and members get actual human concierge help by way of textual content, telephone, or e mail. For typically wholesome self-employed people with an EIN, SOLO constantly delivers significant price financial savings—typically 30–50% lower than conventional plans—whereas offering clearer protection, higher service, and suppleness that truly suits freelance life.

Solo Well being Collective Professionals & Cons ‣

Professionals:

- Considerably decrease prices than most market plans (typically 30-50% much less)

- Easy, clear pricing with no hidden charges or complicated coinsurance

- Your deductible equals your out-of-pocket most (large simplification)

- Preventive care lined 100% earlier than and after assembly deductible

- Nationwide PPO community (1.4M+ suppliers throughout all 50 states)

- No open enrollment interval—be part of anytime

- Tax-deductible as a enterprise expense

- HSA-eligible plan choices ($2,500 and $5,000 deductible plans)

- Distinctive concierge help (name, textual content, e mail, or schedule consultations)

- Consists of health perks (32 month-to-month FitOn credit, $100+ worth)

- Constructed by a family-owned enterprise that prioritizes private service

Cons:

- Requires you to be self-employed with an EIN (not for everybody)

- Well being questionnaire required—not assured approval

- Will not be ideally suited for these with important pre-existing situations

- Requires lively participation in managing your healthcare

- Not accessible when you’ve got staff

- Comparatively new firm (much less established than conventional insurers)

The Healthcare Headache for Self-Employed Individuals

Earlier than diving into Solo, let’s discuss why medical insurance is such a headache for freelancers & Solopreneurs within the first place.

Once you work for an organization, medical insurance is easy. Your employer negotiates with insurance coverage corporations, secures group charges, typically pays a good portion of your premium, and handles all of the paperwork. You simply choose a plan and present as much as the physician.

Once you’re self-employed? You’re by yourself.

The Conventional Choices (And Why They Could Fall Brief)

That’s to not say there aren’t choices for Solopreneurs and freelancers. However a lot of them fall in need of the “ideally suited” situation. Let’s check out some in style present choices:

A. Market Plans (ACA/Obamacare): These are the plans you discover on healthcare.gov or your state change. They arrive in Bronze, Silver, Gold, and Platinum tiers.

The issues:

- Costly premiums: With out employer subsidies, you’re paying $400-800+ monthly for particular person protection

- Excessive deductibles: Even “good” plans typically have $3,000-6,000 deductibles

- Advanced price buildings: Copays, coinsurance, out-of-pocket maximums—it’s designed to confuse you

- Rising prices: State market premiums elevated by a median of 26% this 12 months; Much more should you misplaced your subsidy, like many people did.

- Restricted networks: Many plans prohibit you to particular suppliers and penalize out-of-network care

B. Brief-Time period Plans: These are momentary protection choices, often lasting 3-12 months. Plans like MEC (Minimal Important Protection), for instance.

The issues:

- Don’t cowl pre-existing situations: In case you have any ongoing well being points, you’re out of luck

- Exclude important advantages: Many don’t cowl prescriptions, psychological well being, or maternity care

- Not ACA-compliant: They’re designed to be low-cost, not complete

- Go away you susceptible: If one thing critical occurs, you would be financially ruined

C: Restricted Plans: These cowl solely particular companies, like emergency care or preventive visits.

The issues:

- Main gaps in protection: Hospital stays, surgical procedures, and critical sicknesses typically aren’t lined

- False sense of safety: You suppose you’re protected till you really want care

- Excessive out-of-pocket prices: When one thing isn’t lined, you pay 100% your self

The fact is that none of those choices had been designed with self-employed individuals in thoughts. They’re both too costly, too restricted, or too dangerous.

That’s the issue Solo is fixing for Solopreneurs, freelancers, and self-employed individuals like us.

How Solo Well being Collective Really Works

Solo makes use of a very completely different strategy known as a captive insurance coverage mannequin.

Right here’s what meaning in plain English:

As an alternative of being simply one other particular person shopping for insurance coverage from a large company, you turn into a part of a collective—a group of self-employed people who pool sources to fund healthcare prices collectively.

Consider it like this: Massive corporations can negotiate higher medical insurance charges as a result of they’ve a whole bunch or 1000’s of staff. Solo basically creates that very same shopping for energy for Solopreneurs by bringing collectively many “companies of 1” underneath a single self-funded well being plan.

The Key Distinction

Right here’s the largest key distinction between conventional insurance coverage and Solo:

Conventional insurance coverage: You pay premiums to an insurance coverage firm. That firm decides what’s lined, how a lot suppliers are paid, and the way claims are dealt with. Their aim is revenue, which regularly means denying claims or limiting protection.

Solo’s mannequin: You and different members collectively personal the captive and fund the well being plan. Everybody has a stake in preserving prices affordable, which suggests the main focus is on getting high quality care at truthful costs—not maximizing insurance coverage firm earnings.

This construction permits Solo to:

- Negotiate higher charges with suppliers via reference-based pricing

- Get rid of pointless administrative prices

- Go financial savings on to members

- Present clear pricing with out hidden charges

It’s the distinction between being on the mercy of a faceless company versus being a part of a group with shared pursuits.

What You Really Get with Solo

Let me break down precisely what Solo membership consists of:

Nationwide PPO Community

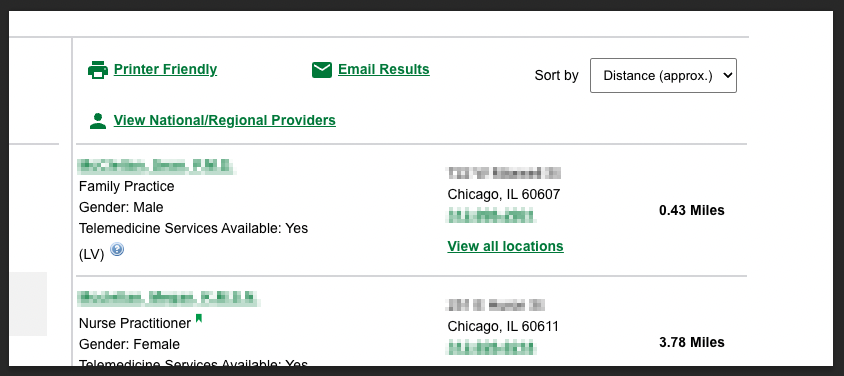

Solo makes use of the MultiPlan PHCS community, which incorporates over 1.4 million suppliers throughout all 50 states.

That is large. You’re not restricted to a slender community or penalized for going out of community. Whether or not you’re house or touring, you’ve got entry to high quality suppliers wherever within the nation.

I checked my physician towards the PHCS community, and he’s in-network. That’s a large aid in comparison with my present market plan, which generally excludes suppliers.

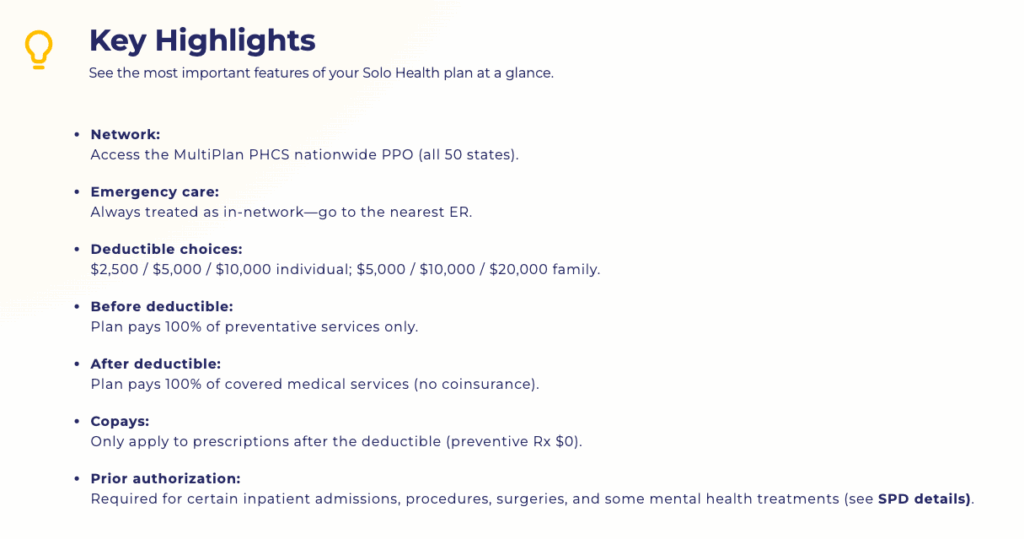

Three Easy Plan Choices

Solo presents three deductible ranges, and that’s it. No complicated tiers, no shock charges:

- V2500 Plan: $2,500 deductible (HSA-eligible)

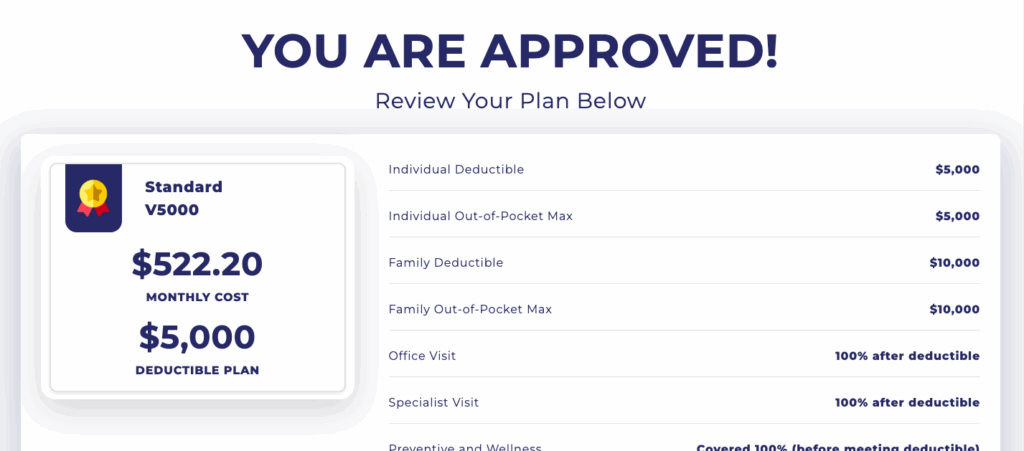

- V5000 Plan: $5,000 deductible (HSA-eligible)

- V10000 Plan: $10,000 deductible

Right here’s what makes this good: Your deductible equals your out-of-pocket most for lined companies.

With conventional insurance coverage, you might need a $3,000 deductible AND an $8,000 out-of-pocket most, which means you would probably pay as much as $8,000 earlier than insurance coverage covers all the things. With Solo, when you hit your deductible, lined companies are paid at 100%. Carried out.

This simplification alone eliminates a lot confusion and anxiousness.

Preventive Care Lined 100%

All preventive care is roofed at 100% earlier than and after you meet your deductible. This consists of:

- Annual bodily exams

- Routine screenings (mammograms, colonoscopies, blood work) primarily based on age/gender

- Immunizations

- Preventive medicines

That is precisely how medical insurance ought to work—encouraging you to remain wholesome and catch issues early, relatively than making you keep away from the physician due to price.

Pharmacy Advantages

After you meet your deductible, prescriptions are lined with a tiered copay construction:

- Tier 1 (Generic): Decrease copay

- Tier 2 (Most well-liked Model): Medium copay

- Tier 3 (Non-Most well-liked Model): Larger copay

- Tier 4 (Specialty): Highest copay

You’ll be able to test precisely what your medicines will price on Solo’s web site earlier than enrolling—no surprises.

Household Protection

Solo isn’t only for people. You’ll be able to cowl your partner and dependents underneath your plan, which is vital for freelancers with households.

The pricing is clear for household protection, and also you’re all lined underneath the identical deductible and out-of-pocket most construction.

HSA Compatibility

The V2500 and V5000 plans are HSA-eligible, which means you may contribute to a Well being Financial savings Account and get the triple tax profit:

- Contributions are tax-deductible

- Development is tax-free

- Withdrawals for medical bills are tax-free

For self-employed people, HSAs are probably the greatest tax benefits accessible. The truth that Solo’s plans are HSA-compatible is a serious profit.

Tax Deductibility

As a result of Solo is structured as a enterprise expense, your premiums are tax-deductible. That is large for freelancers.

Let’s say your Solo premium is $400/month ($4,800/12 months). For those who’re within the 24% tax bracket, that deduction saves you about $1,152 in taxes yearly. Your efficient premium price is de facto solely $3,648/12 months, or $304/month.

(After all, seek the advice of your CPA to verify how this works in your particular scenario, however that is typically the way it works for self-employed people.)

Concierge Help

This may be my favourite function. Solo supplies a devoted concierge help workforce which you could attain by way of:

- Cellphone

- Textual content

- Scheduled consultations

No extra ready on maintain for 45 minutes with a standard insurance coverage firm. No extra automated telephone timber. Simply actual people who really show you how to.

The concierge workforce helps with:

- Understanding your advantages

- Discovering in-network suppliers

- Navigating claims

- Getting price estimates for procedures

- Answering questions on protection

A number of freelancers I spoke with mentioned the concierge help alone makes Solo value it. One informed me: “I texted them a query about whether or not bodily remedy was lined, and bought an in depth response inside 20 minutes. With my previous insurance coverage, that may have taken three telephone calls and every week.”

Health Perks

Each Solo member will get 32 month-to-month FitOn credit (valued at $100+), which you should use for health courses, exercises, and wellness content material.

This may appear to be a small add-on, but it surely reinforces Solo’s philosophy: more healthy members imply decrease collective prices, so that they incentivize staying lively and caring for your self.

Who Can Really Be part of Solo?

Solo isn’t for everybody. There are particular necessities:

You Should Be Self-Employed

This implies you run your individual enterprise as a freelancer, marketing consultant, contractor, or Solopreneur. You can’t have any benefit-eligible W2 staff.

For those who work part-time for an organization that gives well being advantages, you’re not eligible. In case you have a aspect hustle but in addition have a full-time job with employer insurance coverage, you don’t qualify.

Solo is designed solely for people who find themselves really self-employed as their main earnings.

You Want a Federal Tax ID (EIN)

You need to have an Employer Identification Quantity from the IRS. This proves you’re working as a authentic enterprise.

For those who don’t have an EIN, you will get one without cost from the IRS web site in about 10 minutes. You’ll must have a enterprise construction (sole proprietorship, LLC, S-Corp, and so forth.), however that is one thing most critical freelancers ought to have anyway. The truth is, you’re a sole proprietor simply by being alive and in-business.

You Should Go a Well being Questionnaire

Solo requires you to finish a short well being questionnaire. That is used to find out eligibility and pricing.

The questionnaire asks about:

- Present well being standing

- Sure Pre-existing situations

- Medicines

- Latest medical procedures

Right here’s the fact: Solo is designed for typically wholesome people. In case you have important ongoing well being points or require in depth specialised care, you won’t be permitted. Nevertheless, Solo acknowledges that sure well being points aren’t black and white, so if you need to submit for an exception, schedule time with their workforce after you full the questionnaire.

This isn’t ideally suited for some, but it surely’s how Solo retains prices decrease for the collective. Conventional insurance coverage has to just accept everybody no matter well being standing (due to the ACA), which is why premiums are so excessive. Solo’s mannequin requires members to be fairly wholesome to maintain the collective reasonably priced.

Actual-World Price Comparability: Solo vs. Conventional Insurance coverage

Let me present you precise numbers as a result of that is the place Solo actually shines.

I ran quotes for a 35-year-old freelancer in Illinois (my house state) with no pre-existing situations:

Market Gold Plan (Healthcare.gov)

- Month-to-month Premium: $687

- Deductible: $3,000

- Out-of-Pocket Most: $9,200

- Annual Price (if wholesome): $8,244 in premiums + $0 in care = $8,244

- Annual Price (should you hit deductible): $8,244 + $3,000 = $11,244

Solo V5000 Plan

- Month-to-month Premium: $387

- Deductible: $5,000

- Out-of-Pocket Most: $5,000 (similar as deductible)

- Annual Price (if wholesome): $4,644 in premiums + $0 in care = $4,644

- Annual Price (should you hit deductible): $4,644 + $5,000 = $9,644

Financial savings with Solo:

- For those who’re wholesome and solely want preventive care: $3,600/12 months saved

- For those who hit your deductible: $1,600/12 months saved

And keep in mind, with Solo, preventive care is roofed 100%, so that you’d nonetheless have your annual bodily, screenings, and immunizations totally lined with out paying something.

Even should you wanted important medical care and hit your full deductible, you’re nonetheless saving cash in comparison with conventional insurance coverage. And should you’re lucky sufficient to remain wholesome (which is the aim), you’re saving 1000’s of {dollars} yearly.

Household Protection Comparability

For a household of 4 (two adults, two children), the financial savings are much more dramatic:

Market Silver Plan:

- Month-to-month Premium: $1,847

- Household Deductible: $12,700

- Annual Price: $22,164+ (premiums alone)

Solo Household Plan (V5000):

- Month-to-month Premium: ~$950 (varies by household composition)

- Household Deductible: $10,000

- Annual Price: $11,400 (premiums alone)

That’s over $10,000 in annual financial savings simply on premiums, and the deductible is definitely decrease with Solo.

My Expertise Exploring Solo

I went via Solo’s qualification course of to see what it’s really like.

Step 1: Preliminary Questionnaire (10 seconds)

I crammed out a short kind on Solo’s web site with primary data:

E-mail and telephone quantity weren’t required fields, so I may see my charges with out offering my contact data.

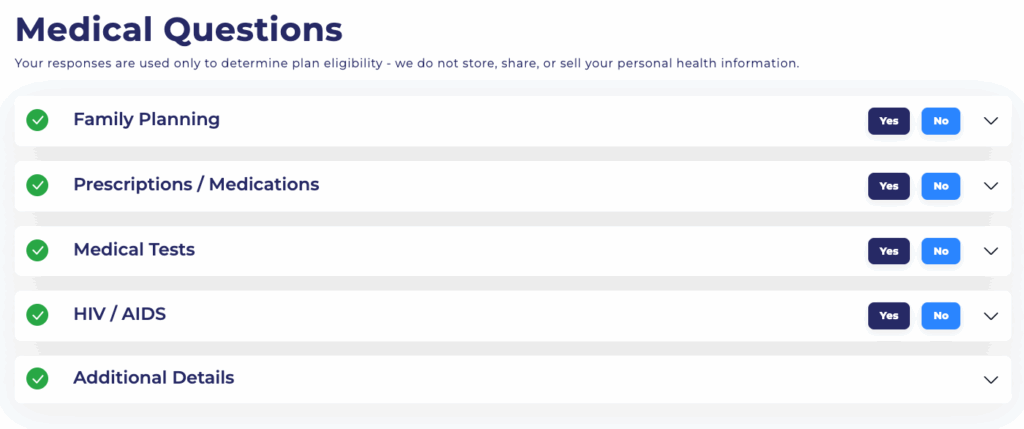

Step 2: Medical Questions (1 minute)

The well being questionnaire requested about:

- Household Planning

- Medicines I’m taking

- Main procedures or exams within the final 5 years

- More information like my peak and weight

This was extra detailed than the preliminary questionnaire however nonetheless easy. It took me about 1 minute.

I imply, that’s loopy. Once I signed up for ‘The Market’, it took me most likely an hour or extra. And once more, I nonetheless didn’t have to offer any contact data, so that is all carried out anonymously.

Step 3: Session with Solo Workforce (Elective)

After submitting the questionnaire, I had the choice to schedule a telephone session with Solo’s workforce. They’re a really small workforce and so they make themselves 100% accessible to reply questions or help you when you’ve enrolled.

That sort of trustworthy, clear communication is uncommon within the insurance coverage world.

Step 4: Enrollment Choice

After the questions or the session, you get permitted to enroll. If I wished to enroll, I may begin protection as quickly as the next month—no ready for open enrollment.

Did you hear that!? No ready for open enrollment! Enroll anytime.

The enrollment course of is easy: select your plan, present cost data, e-sign your paperwork, and also you’re carried out. Your member ID and welcome packet arrive inside a couple of days. Members even have entry to a web based portal the place they’ll entry their ID card, view their claims, and leverage further sources similar to monetary planning instruments.

What I Love About Solo

After in depth analysis, right here’s what genuinely impressed me:

The Pricing Transparency is Refreshing

There aren’t any hidden charges, no shock payments, no complicated explanations of advantages. You already know precisely what you’ll pay:

- Your month-to-month premium

- Your deductible (which can be your max out-of-pocket)

- Your copays for prescriptions (after you hit your deductible)

That’s it. No video games, no gotchas, no “that’s not lined” surprises six months later. The truth is, should you ever really feel like a physician or pharmacy is declining protection incorrectly, you may name the Solo workforce straight and so they’ll assist kind it out. Which brings me to my subsequent level:

The Concierge Help is Distinctive

With the ability to textual content or name a query and get a response inside minutes (not hours or days) eliminates a lot frustration. You’ll NEVER get this with different suppliers.

The Simplicity is a Breath of Recent Air

Three plan choices. Your deductible equals your out-of-pocket most. Preventive care is free. Prescriptions have clear copays.

There’s no confusion about coinsurance percentages, no shock payments as a result of the anesthesiologist was out of community, no combating with customer support about whether or not one thing needs to be lined.

Healthcare is difficult sufficient. Solo removes the insurance coverage complexity so you may concentrate on really getting care.

The Price Financial savings are Actual

Solo appears to price about 30-50% lower than comparable Market protection. That’s 1000’s of {dollars} yearly which you could make investments again into your small business or financial savings.

And since the premiums are tax-deductible, the efficient price is even decrease.

The Flexibility is Good for Freelance Life

No open enrollment restrictions means you may be part of everytime you want protection. Touring? Your nationwide PPO community works in all places. Change areas? Your protection strikes with you.

Conventional insurance coverage ties you to enrollment intervals, particular networks, and geographic restrictions. Solo adapts to your way of life, not the opposite manner round.

The Incentive Construction Makes Sense

By rewarding wholesome behaviors (preventive care, health perks) and inspiring cost-conscious selections (selecting in-network suppliers, reference primarily based pricing solely applies to out-of-network care), Solo aligns your pursuits with the collective’s pursuits.

When everybody advantages from preserving prices affordable, the system works higher for everybody.

What Might Be Higher About Solo

Nothing is ideal. Listed below are the restrictions and disadvantages:

The Well being Questionnaire Requirement

Not everybody will qualify. In case you have important pre-existing situations, power sicknesses, or require in depth ongoing care, Solo won’t settle for you.

That is the tradeoff for decrease prices: Solo works for typically wholesome people. For those who want assured acceptance no matter well being standing, market plans (which should adjust to ACA rules) may be a greater match.

It’s Just for Actually Self-Employed Individuals

For those who’re employed by an organization part-time and freelance on the aspect, you don’t qualify. In case you have staff and are required to offer them with advantages, you don’t qualify.

Solo is solely for Solopreneurs, which is nice for that particular viewers however means it’s not a common answer.

The EIN Requirement Provides a Step

For those who don’t have already got an EIN, you’ll must get one. This isn’t tough (it’s free and takes about 10 minutes on the IRS web site), but it surely’s an additional requirement that some informal freelancers won’t need to cope with.

It’s a Newer Firm

Solo is comparatively new in comparison with established insurers. Whereas meaning they’re modern and customer-focused, it additionally means they don’t have a long time of monitor report. Whereas the Solo plan itself has been round since 2022, their mum or dad firm, Well being Enterprise Group, has been in existence since 2015.

For those who’re risk-averse and like sticking with well-known manufacturers, this may provide you with pause.

Who Ought to Significantly Take into account Solo?

In any case my analysis, right here’s who Solo is ideal for:

Freelancers and Consultants

For those who’re a contract author, designer, developer, marketer, or another kind of impartial marketing consultant, Solo is constructed for you. The associated fee financial savings, flexibility, and tax advantages align completely with the freelance way of life.

Solopreneurs and Unbiased Contractors

Working your individual enterprise as a Solo operator? This consists of professions like actual property brokers and monetary advisors. Solo provides you the well being protection you want with out the complexity and price of conventional small enterprise insurance coverage.

Typically Wholesome Self-Employed People

For those who’re in fairly good well being, don’t have power situations requiring in depth ongoing care, and need to lower your expenses on premiums, Solo is a superb possibility.

Individuals Pissed off with Market Plans

For those who’re uninterested in paying $600+/month for insurance coverage you barely use as a result of the deductible is so excessive, Solo presents a greater worth proposition.

These Who Worth Service and Help

For those who’ve handled irritating customer support from conventional insurers and need a workforce that truly helps you navigate healthcare, Solo’s concierge help is definitely worth the swap alone.

Who May Wish to Look Elsewhere?

Solo isn’t proper for everybody. It is best to most likely persist with conventional insurance coverage if:

You Have Important Pre-Current Circumstances

In case you have power sicknesses, require frequent specialist care, or have ongoing medical wants, market plans that should settle for you no matter well being standing may be a safer alternative.

You Have Workers who you might be required to offer well being advantages

Solo is just for Solopreneurs. In case you have W2 staff, and you want to present them with well being advantages, you seemingly want conventional small enterprise medical insurance.

You’re Employed Half-Time with Advantages

In case you have entry to employer-sponsored insurance coverage (even part-time), that’s most likely your best choice. Solo is just for individuals who don’t have entry to employer protection.

You’re Not Self-Employed

Solo requires you to be legitimately self-employed with an EIN. For those who’re casually freelancing and not using a enterprise construction, you gained’t qualify.

You Favor Most Protection No matter Price

If you need essentially the most complete protection doable and price isn’t a priority, a Platinum market plan may provide extra in depth advantages (although at a a lot greater worth).

How Solo Compares to Alternate options

Let me rapidly examine Solo to the principle options:

Solo vs. Market Plans

Winner: Solo for most individuals

Market plans are dearer, extra complicated, and infrequently have restricted networks. Solo presents higher worth for typically wholesome self-employed people.

Nevertheless, market plans don’t require well being screening and should settle for everybody, so that they’re higher when you’ve got pre-existing situations.

Solo vs. Brief-Time period Plans

Winner: Solo simply

Brief-term plans are cheaper initially however provide minimal protection, don’t cowl pre-existing situations, and go away you susceptible. Solo supplies complete, long-term protection with higher safety.

Solo vs. Well being Sharing Ministries

Winner: Solo

Well being sharing ministries (like Christian Healthcare Ministries or Medi-Share) are related in idea however are faith-based and have non secular necessities. In addition they have limitations on what they’ll cowl (typically excluding pre-existing situations or sure procedures).

Solo presents the same community-based mannequin with out non secular necessities and with extra complete protection.

Solo vs. Direct Major Care + Catastrophic Protection

Winner: Is determined by your wants

Some individuals mix a direct main care membership ($50-150/month for limitless main care visits) with a catastrophic well being plan (high-deductible, low-premium protection for emergencies solely).

This may be cheaper than Solo should you’re younger, wholesome, and infrequently want care. However Solo presents extra complete protection and handles all the things in a single place.

Ideas for Getting the Most Out of Solo

For those who resolve to affix Solo, right here’s how one can maximize the worth:

Begin with the Well being Questionnaire Truthfully

Don’t attempt to disguise well being points or omit data. Solo wants correct data to find out eligibility and pricing. Being dishonest may result in denied claims later and plan termination.

Select the Proper Deductible for Your State of affairs

- V2500: Finest should you count on to want medical care, have ongoing prescriptions, or need decrease out-of-pocket threat

- V5000: Finest middle-ground possibility for most individuals—decrease premiums than V2500, affordable max out-of-pocket

- V10000: Finest should you’re very wholesome, hardly ever see medical doctors, and wish the bottom doable premiums

Use Preventive Care Aggressively

It’s 100% lined, so take benefit! Get your annual bodily, screenings, immunizations, and preventive medicines. Catching well being points early saves cash and improves outcomes.

Open an HSA if Eligible

For those who select the V2500 or V5000 plan, open a Well being Financial savings Account and contribute the utmost allowed. The tax advantages are large for self-employed people.

For 2025, you may contribute as much as $4,300 for people or $8,550 for households.

Use the Concierge Workforce

Don’t hesitate to textual content, name, or e mail with questions. They’re there to assist. Use them to:

- Discover in-network suppliers

- Perceive what’s lined

- Navigate claims or billing points

Keep In-Community When Potential

Whereas Solo’s community is large (1.4M+ suppliers), staying in-network ensures you get the negotiated charges and your prices rely towards your deductible.

Observe Your Healthcare Spending

Since your deductible equals your out-of-pocket most, preserve monitor of what you’ve spent towards your deductible. Leveraging Solo’s partnership with Advantages Hero may help with this. When you hit it, all different in-network companies are lined at 100%.

Take into account Timing for Non-Pressing Care

For those who’re near assembly your deductible late within the 12 months, it’d make sense to schedule non-urgent procedures earlier than year-end so that they’re lined at 100%. For those who’re far out of your deductible, you may wait till the brand new 12 months.

The Backside Line: Is Solo Price It?

After in depth analysis, conversations with members, and private exploration of the plans, right here’s my trustworthy verdict:

Sure, Solo Well being Collective is totally value it for the fitting particular person.

For those who’re a self-employed freelancer or Solopreneur who’s annoyed with costly, difficult conventional insurance coverage, Solo presents a genuinely higher various. The associated fee financial savings alone (typically $3,000-5,000 yearly) justify the swap for most individuals.

However past simply saving cash, Solo solves actual issues:

- The pricing is clear and trustworthy

- The protection is complete and simple

- The help is outstanding and accessible

- The pliability matches freelance existence

- The tax advantages add important worth

The constraints are actual however manageable:

- It’s worthwhile to be self-employed with an EIN

- It’s worthwhile to cross the well being questionnaire

- It’s worthwhile to be keen to actively handle your healthcare

For the audience—typically wholesome self-employed people—these necessities aren’t dealbreakers. They’re simply a part of how Solo retains prices low whereas sustaining high quality protection.

For those who’re nonetheless undecided, be happy to learn different trustworthy opinions on Trustpilot.

My suggestion: For those who’re at the moment paying $500+/month for market insurance coverage that you simply’re not pleased with, completely get a quote from Solo. Schedule a session with their workforce (it’s free and no-pressure), examine the prices to your present plan, and see should you qualify.

For many freelancers and Solopreneurs, switching to Solo will save 1000’s of {dollars} yearly whereas offering higher protection and help. That’s not advertising hype—that’s the fact primarily based on precise price comparisons.

The worst that occurs? You get a quote, notice it’s not best for you, and stick together with your present plan. One of the best that occurs? You discover a medical insurance answer that truly works in your freelance way of life and saves you important cash.

Able to see should you qualify? Go to Solo Well being Collective and take the fast questionnaire. You’ll get customized pricing and might schedule a session with their workforce to ask questions.

And should you do be part of Solo, come again and tell us the way it goes! We’d love to listen to actual experiences from members of our freelance group.

Hold the dialog going…

Over 10,000 of us are having every day conversations over in our free Fb group and we would like to see you there. Be part of us!